Bankruptcy Watch

Warning: For Full Access Please Log In or Create an Account (Free)

I'm betting there will be lots of travel industry and restaurant industry bankruptcies and permanent closings.

In this poll of 100 millionaires on what they like to spend money on the most, the top 5 most common were

[www.businessinsider.com]

1. Travel; 2. Eating Out; 3. Cars; 4. Wine; 5. Clothes

Studies and surveys consistently show that the wealthy do not wish to expose themselves to the virus and are not going out to spend as much. The easiest way to expose yourself is probably through a restaurant or crowded travel.

In this poll of 100 millionaires on what they like to spend money on the most, the top 5 most common were

[www.businessinsider.com]

1. Travel; 2. Eating Out; 3. Cars; 4. Wine; 5. Clothes

Studies and surveys consistently show that the wealthy do not wish to expose themselves to the virus and are not going out to spend as much. The easiest way to expose yourself is probably through a restaurant or crowded travel.

From a mystery shopping perspective, what percentage of shops were in the travel industry?

I rarely saw hotel and cruise shops. They were unicorns in terms of emails I got. Plenty of restaurants, though. Those will be dearly missed.

Dining out was the most enjoyable part of ms-ing for me. My family members enjoyed it too, as I treated them to shops of restaurants they liked or wanted to try and didn't want to pay for.

I rarely saw hotel and cruise shops. They were unicorns in terms of emails I got. Plenty of restaurants, though. Those will be dearly missed.

Dining out was the most enjoyable part of ms-ing for me. My family members enjoyed it too, as I treated them to shops of restaurants they liked or wanted to try and didn't want to pay for.

For me 90%. Most of the assignments were via direct contact with schedulers, no emails went out.

Town Sports International, owner of New York Sports Club, Lucille Roberts, Boston Sports Club, and other brands, filed Chapter 11 bankruptcy today.

[www.reuters.com]

The article points out that Gold's Gym filed in May.

[www.reuters.com]

The article points out that Gold's Gym filed in May.

Interesting, MMMM.@MMMM wrote:

For me 90%. Most of the assignments were via direct contact with schedulers, no emails went out.

Also, I meant what % of all shops that exist are travel industry-related rather than what % of those were that way for any one particular person.

But, that's still interesting to know, nonetheless! I think I was just trying to gauge how big of a hit MS-ing might take from what I expect will be the hardest hit of all business industries.

But, that's still interesting to know, nonetheless! I think I was just trying to gauge how big of a hit MS-ing might take from what I expect will be the hardest hit of all business industries.

Steinmart filed. They have been having a going-out-of-business sale, but it is in-store only, not online.

The famous NYC bar, Coyote Ugly, has closed. Rent renegotiations were a no-go: [ny.eater.com]

A movie was made some years ago based on this bar.

Edited 1 time(s). Last edit at 09/15/2020 11:41PM by Susan L..

A movie was made some years ago based on this bar.

Edited 1 time(s). Last edit at 09/15/2020 11:41PM by Susan L..

[www.cnbc.com]

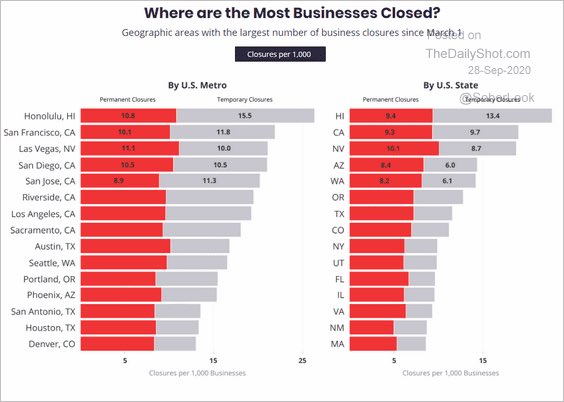

Yelp shows 60% of business closures from COVID are now permanent. Slightly different topic, but kind of related. Hawaii and California are the hardest hit so far.

This article also mentioned California Pizza Kitchen was another restaurant chain that filed.

In the first several weeks we had over 200 restaurants close for good in this state which is not heavily populated. While I thought we had too many eateries I did not want them to have to close this way.

California looks like they arecreally having a hard time. I expected New York and New Jersey to have shown a rougher time than these stats show, so I take whatever "good news" I can.

And God knows how many were just closed and the owners walked away from them.

possibly wildfires-related too@Susan L. wrote:

California looks like they arecreally having a hard time. I expected New York and New Jersey to have shown a rougher time than these stats show, so I take whatever "good news" I can.

Also, Hawaii could be hurting for a long time. It's disconnected from the U.S. and requires a plane to get to, which no one is taking these days! And it relies heavily on tourism for its economy.  It's the perfect storm to crush Hawaii!

It's the perfect storm to crush Hawaii!

It's the perfect storm to crush Hawaii!

It's the perfect storm to crush Hawaii!

Ruby Tuesday, saying the pandemic eviscerated their business, filed Chapter 11:

[news.yahoo.com]

[news.yahoo.com]

I haven't eaten there in years.@Susan L. wrote:

Ruby Tuesday, saying the pandemic eviscerated their business, filed Chapter 11:

[news.yahoo.com]

We used to go with family all the time, but it felt like their food quality and service hadn't kept up with other options.

If I'm not mistaken, they used frozen meals for their entrees. I did like their Garden Bar, however, as it was the main reason I went. Sad somewhat, but not surprised they filed.

[www.marketwatch.com]

YogaWorks is filing. Shares are down close to 70% this year.

Edited 1 time(s). Last edit at 10/15/2020 11:58AM by shoptastic.

YogaWorks is filing. Shares are down close to 70% this year.

Edited 1 time(s). Last edit at 10/15/2020 11:58AM by shoptastic.

Rubio's is the latest:

[www.nbcsandiego.com]

Chuck E. Cheese, Neiman Marcus, Hertz, J.C. Penney, New York & Co., etc., in the meantime, doled out millions in bonuses to executives right before their companies filed:

Their creditors and shareholders must be thrilled.

[www.nbcsandiego.com]

Chuck E. Cheese, Neiman Marcus, Hertz, J.C. Penney, New York & Co., etc., in the meantime, doled out millions in bonuses to executives right before their companies filed:

[www.washingtonpost.com]@ wrote:

Labor experts and bankruptcy attorneys say the payouts are particularly egregious — and unjustifiable — during an economic crisis, and were timed to bypass a 2005 law passed specifically to prevent executives from prospering while their companies flailed.

Their creditors and shareholders must be thrilled.

Friendly's joins the club: [www.bloomberg.com]

@shoptastic wrote:

Chuck E. Cheese, Neiman Marcus, Hertz, J.C. Penney, New York & Co., etc., in the meantime, doled out millions in bonuses to executives right before their companies filed:

[www.washingtonpost.com]@ wrote:

Labor experts and bankruptcy attorneys say the payouts are particularly egregious — and unjustifiable — during an economic crisis, and were timed to bypass a 2005 law passed specifically to prevent executives from prospering while their companies flailed.

Their creditors and shareholders must be thrilled.

The creditors and shareholders should ask the judge to claw back those bonuses. How evil!

Just about any island state or nation is hurting. They are all finding out what Cuba had to endure.

@shoptastic wrote:

Also, Hawaii could be hurting for a long time. It's disconnected from the U.S. and requires a plane to get to, which no one is taking these days! And it relies heavily on tourism for its economy.It's the perfect storm to crush Hawaii!

CBL and other malls are filing because many mall tenants are leaving and spaces are not being filled.

Nature does not hurry, yet everything is accomplished. - Lao-Tzu

My local mall is a CBL property. I saw them in the news.@Shop-et-al wrote:

CBL and other malls are filing because many mall tenants are leaving and spaces are not being filled.

AMC's situation looks dire:

[finance.yahoo.com]

[finance.yahoo.com]

They issued new stock shares to try to raise capital to avoid bankruptcy. With a possible nasty COVID winter and no end in sight to the virus situation yet, I don't know how long they can continue taking losses (and what equity investors would be willing to buy a stake for).@ wrote:

AMC reported its Q3 earnings on Monday, and the numbers were brutal. Revenue fell 91% from one year ago to $119.5 million, while losses ballooned to $905 million from a loss of $54.8 million one year ago.

On Tuesday, shares of AMC surged 12% after the company disclosed that it has reopened nearly all of its U.S. theaters: 539 out of 600. That stat cheered investors.

But while some used the opportunity to pile into AMC, there’s little cause for optimism that the situation is going to get much better any time soon. Look closer at the AMC earnings call on Monday, and you’ll find mostly doom and gloom.

AMC's stock surged 60%+ in pre-market trading on Pfizer vaccine news. Maybe they won't go bankrupt after all.

[www.sun-sentinel.com]

YouFit - fitness gym chain (85 locations) files. Never heard of them.

YouFit - fitness gym chain (85 locations) files. Never heard of them.

@ wrote:

The business, with 85 locations in 10 states, is based in Deerfield Beach and operates 61 clubs in Florida, including 40 in Miami-Dade, Broward and Palm Beach counties.

Others that have filed for bankruptcy since the pandemic began include Gold’s Gym International, YogaWorks, Cyc Fitness, Flywheel Sports, and 24 Hour Fitness.

[www.bloomberg.com]

@ wrote:

Guitar Center Inc., the largest musical instrument retailer in the U.S., said it expected to file for bankruptcy after reaching an agreement to restructure its debt.

Sorry, only registered users may post in this forum.