ETF's

Warning: For Full Access Please Log In or Create an Account (Free)

I have some ETFs, along with individual stocks.

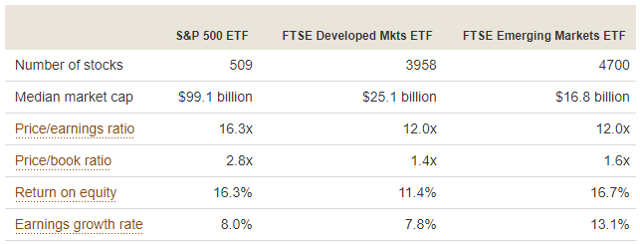

My ETFs are not in U.S. broad indexes, however, as I think the U.S. is wildly overvalued (although, I do own individual U.S. stocks). I have some emerging market and developed market ETFs, however. I wrote about this twice on the forum already, so am hesitant to go into a big post again, lol (doubt ppl want to hear it again).

ETFs have low cost advantages over actively managed funds usually and are, of course, diversified over single stocks. But, a big key with any investment is valuation (relative to fundamentals). So, for me, it's not so much about whether I own a passively managed fund, an actively managed fund, or some individual stock (I am okay with all three), but instead the value of the underlying asset.

What are you looking to buy or know more about?

My ETFs are not in U.S. broad indexes, however, as I think the U.S. is wildly overvalued (although, I do own individual U.S. stocks). I have some emerging market and developed market ETFs, however. I wrote about this twice on the forum already, so am hesitant to go into a big post again, lol (doubt ppl want to hear it again).

ETFs have low cost advantages over actively managed funds usually and are, of course, diversified over single stocks. But, a big key with any investment is valuation (relative to fundamentals). So, for me, it's not so much about whether I own a passively managed fund, an actively managed fund, or some individual stock (I am okay with all three), but instead the value of the underlying asset.

What are you looking to buy or know more about?

The logic behind buying ETFs is basically buying a diversified portfolio usually at a lower management cost than buying a mutual fund. If you open an online brokerage account that does not charge commissions on trades, ETFs can be a quite reasonable way to participate in growth in the market.

There are varieties of ETFs to consider. There are specific sectors of the market in which you can invest and there are the broader market index funds. My sense is that the base of a stock portfolio should be as broad as possible, and that calls for an index fund such as DIA (which mimics the Dow Industrial Average), SPY (mimics the S&P 500) and QQQ (mimics the NASDAQ). Generally the specific sectors of the market that performed best during the previous year is not the sectors that perform best during the current year.

There are varieties of ETFs to consider. There are specific sectors of the market in which you can invest and there are the broader market index funds. My sense is that the base of a stock portfolio should be as broad as possible, and that calls for an index fund such as DIA (which mimics the Dow Industrial Average), SPY (mimics the S&P 500) and QQQ (mimics the NASDAQ). Generally the specific sectors of the market that performed best during the previous year is not the sectors that perform best during the current year.

This also applies to regions/countries.@Flash wrote:

Generally the specific sectors of the market that performed best during the previous year is not the sectors that perform best during the current year.

(Lyn Alden used to have a chart going back to the 1970's, but I can't seem to find it, so here is one for 3 decades.)

Almost without exception, when there is regional outperformance for a decade, the next decade has seen underperforming returns (as the bubbles deflate) for that region.

In the 1980's, it was Japan and Europe. Japan's stock market notoriously hit 39,000 in 1989 and for 30+ years has never seen the same level again, as it was wildly overvalued. Now, Japan is reasonably priced (and Warren Buffett has recently invested there). Then, the U.S. went on a tear in the 1990's (netting 5x and 6x gains for various indexes - tech being the best) and the dot com bubble burst in 2001. It took 15 years for the tech-heavy Nasdaq to recover. From 2001 to 2008 (as the U.S. was deflating from it's bubble), emerging markets (largely driven by China's modernization and growth narrative) was the outperforming region - netting 5x gains. Then, in 2008, emerging markets got crushed for 10 years, as they were wildly overvalued. The U.S. was cheap in 2008 (after deflating for a decade) and it went on its tear for 12 years. Now, the U.S. with a CAPE Shiller P/E of 33 (whereas the historical average is 16) is massively overvalued.

Europe and emerging markets are cheap. Europe is cheap for good reason, though, as it's a debt-disabled economic bloc with bad and aging demographics, anemic economic growth, and socialism. Emerging markets are cheap (having fully deflated from its bubble) with higher growth than the U.S. and Europe, growing capitalism, lower debt, and much better demographics (India, in particular).

I am highly bullish emerging markets for the 2020's decade. India, in particular, is where I have a considerable amount invested. It has the second largest population on planet Earth and is in a stage many consider to be 2000's China. They are just beginning to enter the modern age and knowledge economy (while still industrializing too). They have a "demographic dividend" often talked about. For the next several decades, India's working age population will be larger than all other age demographic groups. This is very, very rare and usually bodes well for economic growth in countries with this dynamic (assuming a reasonably open/capitalistic market, which Modi has oriented India's economy toward). I liked them a lot pre-COVID, but even more so after the pandemic as many developed nations' top companies and supply chains are being rerouted out of China and into India, as they blame China for its handling of COVID, IP theft practices, and underhanded business practices. India has both a highly educated knowledge economy labor pool and an industrial/manufacturing one that top corporations can take advantage of, friendly business practices, and a less corrupt and transparent government.

INDA is the most popular India ETF

VWO, EEM, and IEMG are the main emerging markets ETFs

EMXC is emerging markets ex-China

I own and combine VWO & EMXC to moderate the influence of China's weighting on emerging market ETFs. Usually, emerging market ETFs weight China at about 30% of all holdings. That's too much, imho, and I don't entirely trust Chinese businesses and their nation's economic output reports (it is common knowledge the Chinese government cooks the books on GDP and economic output). I want some exposure to China, but not too much and use VWO + EMXC to do that. INDA is EMXC's largest holding (yes, an ETF inside of an ETF).

Edited 5 time(s). Last edit at 01/19/2021 12:51AM by shoptastic.

INDA, by the way, is expensive from a valuation perspective. It trades at a much higher P/E ratio than other emerging market countries, given its current and expected economic growth rates and trajectory. If one is just buying INDA vs broad emerging markets ETFs, that may be important to know. It's been expensive for a while now, as most people know about its prospects. It's difficult to buy it at a discount, but 2020 offered probably a once-in-a-decade opportunity. It's back to a high valuation now and likely will remain that way for decades to come.

Thank you so much for replying! I am educated with ETFs. Do you trade actively?

I don't day trade, but I do actively manage/"trade" my retirement account and will make moves when appropriate.@Madetoshop wrote:

Do you trade actively?

If you're new, definitely use a reputable brokerage like Vanguard or Fidelity. Avoid Robinhood (phone app) at all costs, as horror stories are coming up with people's accounts hacked and Robinhood not believing them and not returning their money. Vanguard has multi-level security you can ask for, where EVERY single time you login, they will call your landline phone number after you enter your password to give you a passcode. You then use that one-time unique code to enter their brokerage. If you log-out, you'll need a new one. So, unless some criminal dood goes to your house and literally hacks your physical landline phone, no one is getting into your account.

Yeah. Currently more than 70% of my total portfolio is indexed via ETF’s or actively managed ETF’s:

S&P500 (VOO, FXAIX and Black Rock’s mutual fund for my 401k).

Tech (ARKK, QQQ, etc.)

EV (QCLN).

Airlines (JETS)

Then the rest are a bunch of individual stocks like Tesla, FAANG, Disney, etc.

S&P500 (VOO, FXAIX and Black Rock’s mutual fund for my 401k).

Tech (ARKK, QQQ, etc.)

EV (QCLN).

Airlines (JETS)

Then the rest are a bunch of individual stocks like Tesla, FAANG, Disney, etc.

Very infrequently shopping the Greater Denver Area, Colorado Springs and in-between in Colorado these days.

Yes Tarantado, VOO if we make the move. :-)

@Madetoshop wrote:

Yes Tarantado, VOO if we make the move. :-)

I’d say make the move for the majority of your liquid assets if you’re holding lots of cash. It follows S&P500, decent risk, very low expense ratio (0.03%) and of course, it’ll highly likely beat the majority of retail investors without you needing to take any gambles and will highly likely beat inflation by far.

Very infrequently shopping the Greater Denver Area, Colorado Springs and in-between in Colorado these days.

Madetoshop,@Tarantado wrote:

@Madetoshop wrote:

Yes Tarantado, VOO if we make the move. :-)

I’d say make the move for the majority of your liquid assets if you’re holding lots of cash. It follows S&P500, decent risk, very low expense ratio (0.03%) and of course, it’ll highly likely beat the majority of retail investors without you needing to take any gambles and will highly likely beat inflation by far.

Given today's market valuations, I would not use a lump sum approach to investing in VOO.

With all candor, I would not be investing in VOO at all (not without a 10% market drop at minimum & only via DCA). I suppose if one has a long enough investing time horizon (decades) and won't need the money put in, then dollar cost averaging (whether putting in $x.xx every month...two months...three months...or whatever interval) is okay and what all investment professionals would recommend.

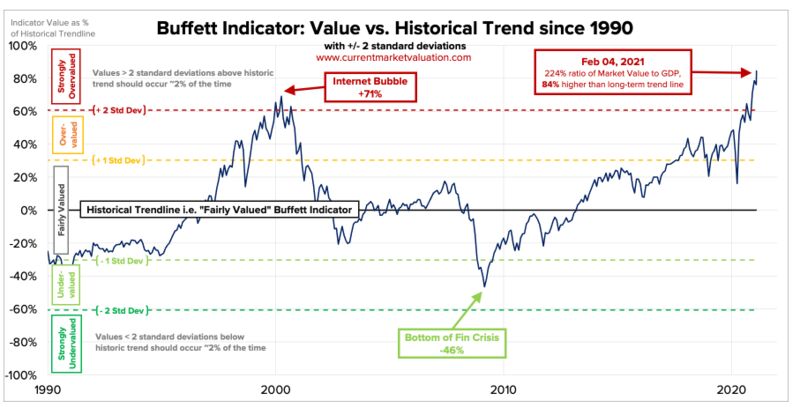

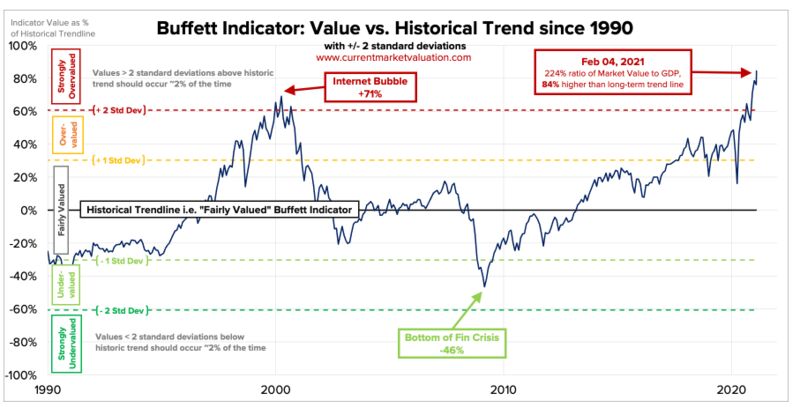

But, given market valuations, I think lump sum-ing (esp., a large one) is very dangerous, while DCA-ing is okay, but still not optimal for my own "tastes." Consider that U.S. stocks are in the 99th percentile of historical valuation right now and using Warren Buffett's own "Buffett Indicator," we get a 1.85 market cap-to-GDP ratio today vs. 1.4 at the March 2000 peak of the dot com bubble.

Speaking of that bubble (in which my parents lost quite a bit of money), Jesse Felder had a blog commentary a couple of weeks ago on Price-to-Sales ratios in the S&P 500 (which VOO tracks) comparing 2000/01 to 2020/21:

"What Were You Thinking?" Part Tres (Jan. 6, 2020)

[thefelderreport.com]

@ wrote:

Indeed, what were investors thinking 20 years ago not only paying 10 times revenues for Sun Microsystems but also paying that ridiculous multiple for 44 other stocks in the S&P 500 Index? It’s impossible to know for sure but it’s a good bet they were simply counting on the “greater fool theory” or the idea that someone will come along and pay an even more ridiculous price than they did. At some point, however, the market ran out of fools and the Nasdaq fell 83%.

It’s interesting to note that we seem to have found even more fools today than we did back then. Nearly 60 of the S&P 500 Index components currently trade more than 10 times revenues. There’s no telling when the current market will run out of fools this time but, when it’s all said and done, that last buyer may justly earn the title “greatest fool” of all time. And only with the benefit of hindsight will it really feel like the abject folly it should.

@shoptastic wrote:

Madetoshop,

Given today's market valuations, I would not use a lump sum approach to investing in VOO.

With all candor, I would not be investing in VOO at all (not without a 10% market drop at minimum & only via DCA). I suppose if one has a long enough investing time horizon (decades) and won't need the money put in, then dollar cost averaging (whether putting in $x.xx every month...two months...three months...or whatever interval) is okay and what all investment professionals would recommend.

But, given market valuations, I think lump sum-ing (esp., a large one) is very dangerous, while DCA-ing is okay, but still not optimal for my own "tastes." Consider that U.S. stocks are in the 99th percentile of historical valuation right now and using Warren Buffett's own "Buffett Indicator," we get a 1.85 market cap-to-GDP ratio today vs. 1.4 at the March 2000 peak of the dot com bubble.

Speaking of that bubble (in which my parents lost quite a bit of money), Jesse Felder had a blog commentary a couple of weeks ago on Price-to-Sales ratios in the S&P 500 (which VOO tracks) comparing 2000/01 to 2020/21:

"What Were You Thinking?" Part Tres (Jan. 6, 2020)

[thefelderreport.com]

@ wrote:

Indeed, what were investors thinking 20 years ago not only paying 10 times revenues for Sun Microsystems but also paying that ridiculous multiple for 44 other stocks in the S&P 500 Index? It’s impossible to know for sure but it’s a good bet they were simply counting on the “greater fool theory” or the idea that someone will come along and pay an even more ridiculous price than they did. At some point, however, the market ran out of fools and the Nasdaq fell 83%.

It’s interesting to note that we seem to have found even more fools today than we did back then. Nearly 60 of the S&P 500 Index components currently trade more than 10 times revenues. There’s no telling when the current market will run out of fools this time but, when it’s all said and done, that last buyer may justly earn the title “greatest fool” of all time. And only with the benefit of hindsight will it really feel like the abject folly it should.

You’re talking about bubbles, but even you don’t have a crystal ball to predict the future. If the plan is to buy and hold for the long term (10+ years), then DCA vs. front loading will make little difference. When the market does dip, that you increase you investing amount to buy the dip.

What could be more damaging is timing the market (what you’re suggesting) and holding cash when basic investing strategies (not timing the market and continually investing) is literally the best for 99% of retail investors.

If the bubble is here and you can time it, why not sell outs or even riskier, buy put options?

Very infrequently shopping the Greater Denver Area, Colorado Springs and in-between in Colorado these days.

Yeah, I think Madetoshop probably remembers my post on lump sum investing vs. DCA back in March of 2020?@Tarantado wrote:

If the plan is to buy and hold for the long term (10+ years), then DCA vs. front loading will make little difference. When the market does dip, that you increase you investing amount to buy the dip.

[www.mysteryshopforum.com] It's true that studies show investing a big sum all at once earlier is better than spreading it out over time. However, in that post, I never specified what the actual numbers were when I said

"But, a smaller percentage of the time, this fails, because you could be investing at a horrible time:. . ."

I'd need to double-check this, but if memory serves me correctly, the study showed that 2/3 of the time, lump sum beat DCA. So, that leaves 1/3 of the time when DCA was better. I don't recall if the study matched the lump sum strategy results with market valuations at the time of investment or not. If it was valuation-blind, then that could be a huge disadvantage. Going through it logically in my head, I think it would have had to have been valuation-blind.

Also, by lump sum, I'm thinking of something that is "significant" to the investor (which can be $5,000 for one person or $50,000 for another) and may have taken a year or more to save up, such that they would not be able to immediately invest that same amount very easily within just a few months if the market crashed (I agree with you that you can always invest more if the market crashes to capture those gains). So, it's sort of like asking, what if you bought $35,000 worth of stocks in 2000 and couldn't buy again for another year (at least, not that full amount)? The Dow and S&P took 7 years to recover back to 2000 levels after the bottom of 2001's crash. The Nasdaq took 15 years to get back to 2000 levels (all the way to 2015). Those were nominal values, so inflation-adjusted returns took even longer!

A 1/3 random chance of lump summing into a massive crash is seemingly significant enough to warrant some thought of alternatives and think about valuations at the time. Granted, a person could have sold their S&P 500 index in 2003 or something and bought into emerging markets for a better gain than waiting until 2007 to get their money back.

I think this part is where there was probably some subtle confusion over what I wrote (maybe it was my fault for how I worded things).@ wrote:

What could be more damaging is timing the market (what you’re suggesting) and holding cash when basic investing strategies (not timing the market and continually investing) is literally the best for 99% of retail investors.

If the bubble is here and you can time it, why not sell outs or even riskier, buy put options?

I actually did say that I felt DCA-ing was a fine idea, as most professional money managers and the greatest investors throughout history would recommend this: just regularly buying an index fund through highs and lows and holding it for many years. I just said that I would wait for a 10% pullback or more before employing DCA, given current valuations. If that seems picky, then I'm guilty of that. On the other hand, I did object to lump summing (esp., if it was a significant amount to an investor) at these valuations. That, I said I would never do.

Mainly, I just think there are better opportunities outside of VOO, which is at historically extreme valuations (which could really crash hard - although, I think the Fed would save investors, as they've done post-2009 with QE). I think if one HAD to lump sum into something, it'd be better to buy broad emerging markets index funds like the ones I listed. Valuations there are cheap and the fundamentals are even better than the U.S.

But, secondly, I think there is confusion over market timing vs. "valuation timing" (if one can use that term). Market timing is saying you believe the market will crash and you'll wait until then to invest for a higher return. I agree that this is a bad strategy and no human throughout history has successfully timed the market with consistency. However, "valuation timing" would simply be buying when stocks are reasonable or cheap and not buying when grossly overvalued. That might lead to sitting out for a while, but this is also completely in line with the greatest investors of all-time. Warren Buffett has said you can sometimes wait several years before buying anything at all: [www.youtube.com] There is no rush. Why buy something that is way overpriced? Maybe that sounds like semantics, but I do think there's a difference between not buying because you predict a crash is coming vs. not buying because prices are way too high. Often a crash does come soon, though, when prices are at extremes. The market always self-corrects. But, as Joel Greenblatt says to his students at Columbia: "I tell them if you're right about the valuation, the market will agree with you eventually. I just never tell them when it will agree."

It could take years! Here is what Buffett has to say about cash incidentally: [www.businessinsider.com]

It could take years! Here is what Buffett has to say about cash incidentally: [www.businessinsider.com]

I don't use options, because if you don't get the timing right, they can expire worthless and you lose money. I'd rather sit on cash and just wait until there is a good opportunity if markets are outrageously priced.

Probably the greatest lump sum fail in history would have been 1929.

The market fell 89% from '29 thru '32. It took 25 years (until 1954) for the market to return to 1929 levels!

I don't think that'd ever happen again, given the advent of QE in 2009. Nowadays, the Fed can save markets with money printing. It's why 2020's crash was so brief and relatively tame (only 35% loss), despite a worse recession than 2008. It wasn't until 2009 that QE was first implemented (incidentally, when markets also bottomed).

The market fell 89% from '29 thru '32. It took 25 years (until 1954) for the market to return to 1929 levels!

I don't think that'd ever happen again, given the advent of QE in 2009. Nowadays, the Fed can save markets with money printing. It's why 2020's crash was so brief and relatively tame (only 35% loss), despite a worse recession than 2008. It wasn't until 2009 that QE was first implemented (incidentally, when markets also bottomed).

Time IN the market is far preferable to attempts at TIMING the market.

My sense is that covid will make it significantly longer for Emerging Markets to do well than for established markets to move forward.

While it smart to have some cash to buy in on dips in the market, with VOO (or SPY) paying about a 1.5% dividend while DIA pays about 1.9% and QQQ pays a little under 1%, sitting in cash in most cases pays less than that in interest and won't beat inflation.

My sense is that covid will make it significantly longer for Emerging Markets to do well than for established markets to move forward.

While it smart to have some cash to buy in on dips in the market, with VOO (or SPY) paying about a 1.5% dividend while DIA pays about 1.9% and QQQ pays a little under 1%, sitting in cash in most cases pays less than that in interest and won't beat inflation.

This is true and a good maxim to remember. Peter Lynch's version is something like, "More people lose money trying to avoid a recession than actual money lost in recessions themselves."@Flash wrote:

Time IN the market is far preferable to attempts at TIMING the market.

I think I would still hold to my lump sum VOO warning, though, given extreme historical valuations. It's interesting that Jack Bogle (inventor of the index fund and who advocated lump sum vs. DCA) "valuation timed" the dot com bubble himself. It's controversial whether what he did was "right" or not, but he cited extreme valuations for pulling out. Warren Buffett took a different approach and just never bought into that bubble (thus, no need to pull out). John Templeton had sold out of U.S. tech stocks several years prior to their crash and was invested in Asia at the time (which did fabulously well in the post-dot com decade). I think, as I said earlier, if I HAD to invest a lump sum into a broad regional index fund (I think there are individual stocks of good value in the U.S., despite hyper-valuation of the indexes as a whole), I'd plunk it down into a combination (50/50 split) between VWO and EMXC at this moment.

Just my 2 cents and 10 million words and running. . .

I think there is a clear separation between Latin American EM vs. Asian EM. Asian emerging markets have done fantastically well with COVID (Thailand, South Korea***, China, Taiwan, Vietnam,...etc.), having locked down and followed safety protocols and their economies are getting back to normal quite well, despite slower vaccination rollout and access. That's because they have so few cases. But, another reason is due to demographics. EM Asia is on average younger than the U.S. and Europe. Some have argued age, along with diet, has led to less deaths among Asian EM nations. LatAm EM, unfortunately, has taken some of the world's harshest hits from COVID - both medically and economically. The poor, dense nations had little resources to combat the disease and they will likely emerge from this pandemic running along slower than other parts of the world.@ wrote:

My sense is that covid will make it significantly longer for Emerging Markets to do well than for established markets to move forward.

Still, I think based purely on a valuation perspective, EM, as a whole, is a great bargain still for long-term investors. It should get a second boost in valuation from a weakening dollar (as EM dollar denominated debt gets relieved more and thus profits will improve).

***South Korea is indexed as both EM and DM (developed markets). It is clearly a first-world nation with one of the most advanced economies on planet Earth, but it's indexed as EM too because it's currency trades on a peg like EM. Kind of weird, but just good to know, b/c you'll see it in both VWO and VEA (Vanguard's emerging markets and developed markets funds).

Edited 1 time(s). Last edit at 01/19/2021 01:53AM by shoptastic.

@shoptastic wrote:

This is true and a good maxim to remember. Peter Lynch's version is something like, "More people lose money trying to avoid a recession than actual money lost in recessions themselves."

I think I would still hold to my lump sum VOO warning, though, given extreme historical valuations. It's interesting that Jack Bogle (inventor of the index fund and who advocated lump sum vs. DCA) "valuation timed" the dot com bubble himself. It's controversial whether what he did was "right" or not, but he cited extreme valuations for pulling out. Warren Buffett took a different approach and just never bought into that bubble (thus, no need to pull out). John Templeton had sold out of U.S. tech stocks several years prior to their crash and was invested in Asia at the time (which did fabulously well in the post-dot com decade). I think, as I said earlier, if I HAD to invest a lump sum into a broad regional index fund (I think there are individual stocks of good value in the U.S., despite hyper-valuation of the indexes as a whole), I'd plunk it down into a combination (50/50 split) between VWO and EMXC at this moment.

You’re comparing the average investor to Warren Buffett.....

Past performance isn’t an indicator of future results. Hence, Time in the Market >>>> Timing It.

I chuckle a little, as back in 2013 when I bought my house, everyone my age kept putting it off talking about that they want to wait for a housing crash..... well, after almost 8 years, the housing market out here more than doubled from this bubble that built up, so even when a housing crash does happen, I would still be far ahead because I bought and held for the long term, vs. my friends that are in their 30’s now and still waiting for this housing apocalypse.

Very infrequently shopping the Greater Denver Area, Colorado Springs and in-between in Colorado these days.

Tarantado - It's a bit frustrating, because I think there's continuous confusion with how you're representing my ideas. I have never advocated market timing.@Tarantado wrote:

You’re comparing the average investor to Warren Buffett.....

Past performance isn’t an indicator of future results. Hence, Time in the Market >>>> Timing It.

If one wants to say value investing is more "advanced" and not the best approach for "average investors," then I think I'd probably agree. That "criticism" of my warnings and advice I'm fine with in the sense that it's maybe more "advanced."

A novice/amateur investor probably should stick with something like DCA-ing into an S&P 500 fund like VOO as a baseline strategy (on top of whatever else they may do). And, if they inherit a large sum of money (say, $200,000 is I think what the Vanguard study used), then it's good to be aware that lump summing has historically beaten DCA-ing 2/3 of the time in history.

All of that I've said before in numerous posts and threads, so that anyone reading my views would know that I support and recognize those findings.

If my advice to Madetoshop seems "advanced" and maybe not the best approach for a novice, then I'm okay with that criticism. I merely wanted to give it still, given how I see markets and valuations. I did buy quite a bit of individual U.S. stocks throughout 2020 (and broad EM funds), but right now I would be very hesitant to do so at these valuations. Take Disney (DIS), a stock we both hold.

I liked their fundamentals after announcing they would go streaming (I thought their debt spending would be long-term accretive to earnings), but missed the rise in stock price and held off buying DIS until March and April of 2020. My average cost basis was around $102, which I thought was slightly high even then. The stock traded at $151 in November 2019 and fell to the $140's in early 2020 as news of the Shanghai resorts shutdowns hit with COVID. Today, most parks and cruises are still shutdown in some fashion (their greatest slice of revenue), their media and ESPN sports ads revenue are also still lagging, and yet the stock is higher now (off the back of Disney+ subscriptions) than pre-pandemic at $170's range, while profits are not expected to get back to 2019 highs until 2023. In short, earnings are way down and won't recover to 2019 levels for two more years and the stock as gone straight up and past pre-COVID highs. I could not in good conscience recommend DIS at today's valuation.

That's not just one stock, but reflective of a lot of what's been happening in the S&P 500. You have a huge basket of crazily overvalued stocks. I thought buying in March/April 2020 was a great idea (and did so), but after that, it's been more and more iffy to the point where I see today's VOO valuation as flat out nuts. In comparison, VWO is historically cheap on relative valuation metrics (compared with U.S. stocks) and fairly priced in absolute terms. That's why I feel if one wants to be consistently invested, why not buy VWO (combined with EMXC) vs. VOO?

Edited 3 time(s). Last edit at 01/19/2021 03:13AM by shoptastic.

@Tarantado wrote:

You’re comparing the average investor to Warren Buffett.....

Indeed, Templeton, Lynch, Buffett et al are fund managers. It is their job to do the research and analysis of the companies in which they plan to invest and they have a staff to do a whole lot of that legwork for them. It frankly would be inappropriate for them to stack their clients' portfolios with index funds rather than doing the homework and analysis they are being paid to do. The fees for 'professional managers' are not cheap and are justified by sending their analysts out to the companies to meet with management and evaluate if the activity they are observing matches what the management is representing. Fund managers also have forensic accountants going through corporate accounting to evaluate their credibility.

There's some confusion above. I wasn't "comparing the average investor to Warren Buffett....."

What I did was mention how Buffett approached the dot com bubble, how he treats cash (linked an article), and how he's fine with waiting years without making a single investment (if all opportunities are expensive). There is a difference between citing something a great professional investor says (in this case, the latter bit was his advice to amateurs!) vs. that principle/strategy being "advanced" or "professional-level" investing advice.

If Buffett says to buy low and sell high, yes, it's advice from a great professional investor, but it's not "advanced" in nature (that only a fund manager can do). It's simple and basic advice every investor can and should implement.

I think one potential issue may be the citing of one investing principle or bit of advice without seeing how it may combine with other principles. Yes, Buffett and others have said it's a great idea to regularly invest into an S&P 500 index fund. But, he's also said to be careful of bubbles and high valuations. One principle doesn't negate the other.

Edited 1 time(s). Last edit at 01/19/2021 04:49AM by shoptastic.

What I did was mention how Buffett approached the dot com bubble, how he treats cash (linked an article), and how he's fine with waiting years without making a single investment (if all opportunities are expensive). There is a difference between citing something a great professional investor says (in this case, the latter bit was his advice to amateurs!) vs. that principle/strategy being "advanced" or "professional-level" investing advice.

If Buffett says to buy low and sell high, yes, it's advice from a great professional investor, but it's not "advanced" in nature (that only a fund manager can do). It's simple and basic advice every investor can and should implement.

I think one potential issue may be the citing of one investing principle or bit of advice without seeing how it may combine with other principles. Yes, Buffett and others have said it's a great idea to regularly invest into an S&P 500 index fund. But, he's also said to be careful of bubbles and high valuations. One principle doesn't negate the other.

Edited 1 time(s). Last edit at 01/19/2021 04:49AM by shoptastic.

Thank you all. DCA is much more comfortable for us but as most of you are aware, lump sum amounts vary as to their intensity with regard to one's portfolio. Timing the market is a big NO for us. ETFs are attractive to us at this point. I think we will invest in them at a moderate pace.

Good luck, Madetoshop!@Madetoshop wrote:

Thank you all. DCA is much more comfortable for us but as most of you are aware, lump sum amounts vary as to their intensity with regard to one's portfolio. Timing the market is a big NO for us. ETFs are attractive to us at this point. I think we will invest in them at a moderate pace.

I do think investing vs. holding cash or Treasuries is a must for the 2020's decade, as I've discussed here:

--stimulus thread (top post) [www.mysteryshopforum.com]

--money saving thread (third to bottom post) [www.mysteryshopforum.com]

The U.S. will have to inflate it's sovereign debt away (as it did in the 1940's), so that means anyone holding Treasury bonds will get paid back less than what they're nominally worth and those holding cash will lose the most in the coming years. The way Americans had to protect themselves in the 1940's was by holding assets (rare art, stocks, precious metals and commodities, fine wine, real estate, etc.) - anything that couldn't be printed basically and which had value for others. Today, many are flocking to even bitcoin for that purpose.

I think the U.S. stock market will keep up with inflation the 2020's (as inflation into consumer prices find their way "up" into corporate earnings), but I do think emerging markets offer better returns - both due to better valuations and from better economic growth and fundamentals. These were the two articles I previously posted in the "Millionaire" thread relating to EM and investing outside of the U.S. if you were interested:

"The Case for Emerging Markets" (Feb. 4, 2019)

[seekingalpha.com]

"This Strategy Tripled The S&P 500 Over 25 Years" (April 26, 2019)

[seekingalpha.com]

You will do fine investing in the U.S. over the long-term. As Warren Buffett has said, it's a bet on America!

If you are open to learning about investing outside the U.S. at all, I'd recommend the articles above and Lyn Alden's pieces on her investment website: [www.lynalden.com] She's grown into a sort of fintwit "rock star" as many have called her these past couple of years. Absolutely amazing investment advice for beginners through advanced-level and publicly lists her performance record for all to see (where she's consistently beaten the markets).

If you are open to learning about investing outside the U.S. at all, I'd recommend the articles above and Lyn Alden's pieces on her investment website: [www.lynalden.com] She's grown into a sort of fintwit "rock star" as many have called her these past couple of years. Absolutely amazing investment advice for beginners through advanced-level and publicly lists her performance record for all to see (where she's consistently beaten the markets).

Just stay off Robinhood!

I'd never seen these comments before today, but Warren Buffett talks about lump sum vs. DCA here:

[www.youtube.com]

He says he'd prefer to dollar cost average and not put a lot of money into the stock market (lump sum) all at one time. He alludes to the fact that you could be putting it in at a horrible time. It's unclear if he's seen studies of lump summing vs. DCA-ing, but it's never a bad idea hear what he thinks!

[www.bloomberg.com]

The article above was an interesting one I saw on Bloomberg this week. It talks about Warren Buffett's favorite stock market valuation indicator and how it's flashing warning signs.

On an absolute basis, how overvalued are U.S. stocks (you can take the Wilshire 5000, which is an index of every publicly traded company in the U.S. and use it in a market cap-to-GNP/GDP ratio that Buffett uses) currently? We would have to lose 30% in the stock market from today just to get back to the March 2000 peak of the dot com bubble (which lost 50%+ from there) valuations, Jesse Felder has calculated. Thinking about that is extremely scary!! Felder has said John Hussman has estimated that we may have pulled forward as much as 20-25 years worth of future demand and stock market returns - leading to a Japan 1989 style 20+ year bear market from overvaluation.

That doesn't mean the stock market will crash tomorrow, as the famous Keynes saying goes: "The stock market can remain irrational longer than you can remain solvent."

But, it's still a good warning to heed. It's also the case that the market doesn't have to crash down. There are two other ways a market can crash: sideways and up. A market might not see a huge down swoop, but just stay in the same place for 10 years or more. Or, it can actually rise nominally, but be losing money in real (inflation adjusted) terms.

Edited 5 time(s). Last edit at 02/17/2021 09:46PM by shoptastic.

[www.youtube.com]

He says he'd prefer to dollar cost average and not put a lot of money into the stock market (lump sum) all at one time. He alludes to the fact that you could be putting it in at a horrible time. It's unclear if he's seen studies of lump summing vs. DCA-ing, but it's never a bad idea hear what he thinks!

[www.bloomberg.com]

The article above was an interesting one I saw on Bloomberg this week. It talks about Warren Buffett's favorite stock market valuation indicator and how it's flashing warning signs.

On an absolute basis, how overvalued are U.S. stocks (you can take the Wilshire 5000, which is an index of every publicly traded company in the U.S. and use it in a market cap-to-GNP/GDP ratio that Buffett uses) currently? We would have to lose 30% in the stock market from today just to get back to the March 2000 peak of the dot com bubble (which lost 50%+ from there) valuations, Jesse Felder has calculated. Thinking about that is extremely scary!! Felder has said John Hussman has estimated that we may have pulled forward as much as 20-25 years worth of future demand and stock market returns - leading to a Japan 1989 style 20+ year bear market from overvaluation.

That doesn't mean the stock market will crash tomorrow, as the famous Keynes saying goes: "The stock market can remain irrational longer than you can remain solvent."

But, it's still a good warning to heed. It's also the case that the market doesn't have to crash down. There are two other ways a market can crash: sideways and up. A market might not see a huge down swoop, but just stay in the same place for 10 years or more. Or, it can actually rise nominally, but be losing money in real (inflation adjusted) terms.

Edited 5 time(s). Last edit at 02/17/2021 09:46PM by shoptastic.

[www.bloomberg.com]@ wrote:

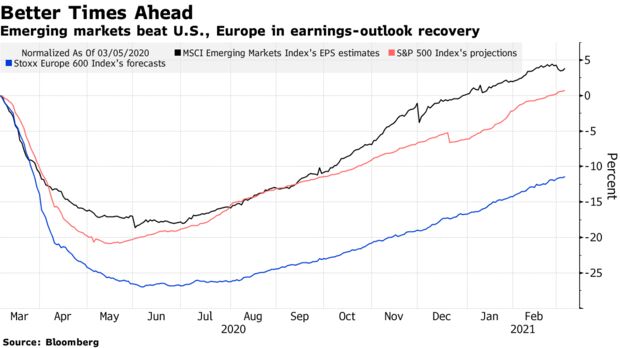

If capital flows into U.S. exchange-traded funds are any indication, investors have begun to favor emerging-market stocks over almost every other asset class -- including U.S. equities. . .

Money managers from Ashmore Group Plc to JPMorgan Chase & Co. and UBS Group AG have been making a bull case for emerging-market equities in 2021 as they expect the group to be the prime beneficiary of the post-coronavirus economic rebound. Asia’s relative success in containing the pandemic, vaccine breakthroughs in China, India and Russia, as well as renewed demand for commodities and Joe Biden’s $1.9 trillion stimulus plan are underpinning the optimism.

Analysts have been raising earnings estimates for emerging-market companies faster than for rich nations. After a meltdown in March 2020, profit forecasts have recovered a net 4% in the developing world. Projections are little changed in the U.S., while they are still 11% lower in Europe.

Yay! for emerging markets! Did anyone buy when I recommended?

Edited 2 time(s). Last edit at 03/08/2021 12:56AM by shoptastic.

Sorry, only registered users may post in this forum.