@shoptastic wrote:

So much fraud took place under TARP that it was a double whammy to distressed homeowners. First get hammered by the broader sub-prime mortgage meltdown economically. Second, have your remaining assets and life-savings squeezed out of you to the last drop (to use Neil Barofsky's words) under the pretense you could qualify for a mortgage modification program to keep your house - only to lose it anyways in the end (due to how incentives were aligned).

Really, this was a triple whammy. Those same fraudulently foreclosed upon homeowners now have the privilege of renting for the rest of their lives, as banks and private equity bought up all those distressed housing assets as millions of people were kicked out of their homes and rented them back out to those SAME people at higher prices.

This as been a huge "trade" for the last decade. Every week my parents get a call from some random person asking to buy their home. We've never heard of them. Often, they are not buying to sell, but instead buying to rent. Private equity has made a killing from renting to desperate people.

It's funny when you look at the hierarchy of the 2020 bailout, who got the most and first?:

hedge funds and private equity (who were levered up to the max and about to go bust)

Edited 3 time(s). Last edit at 04/17/2020 06:41PM by shoptastic.

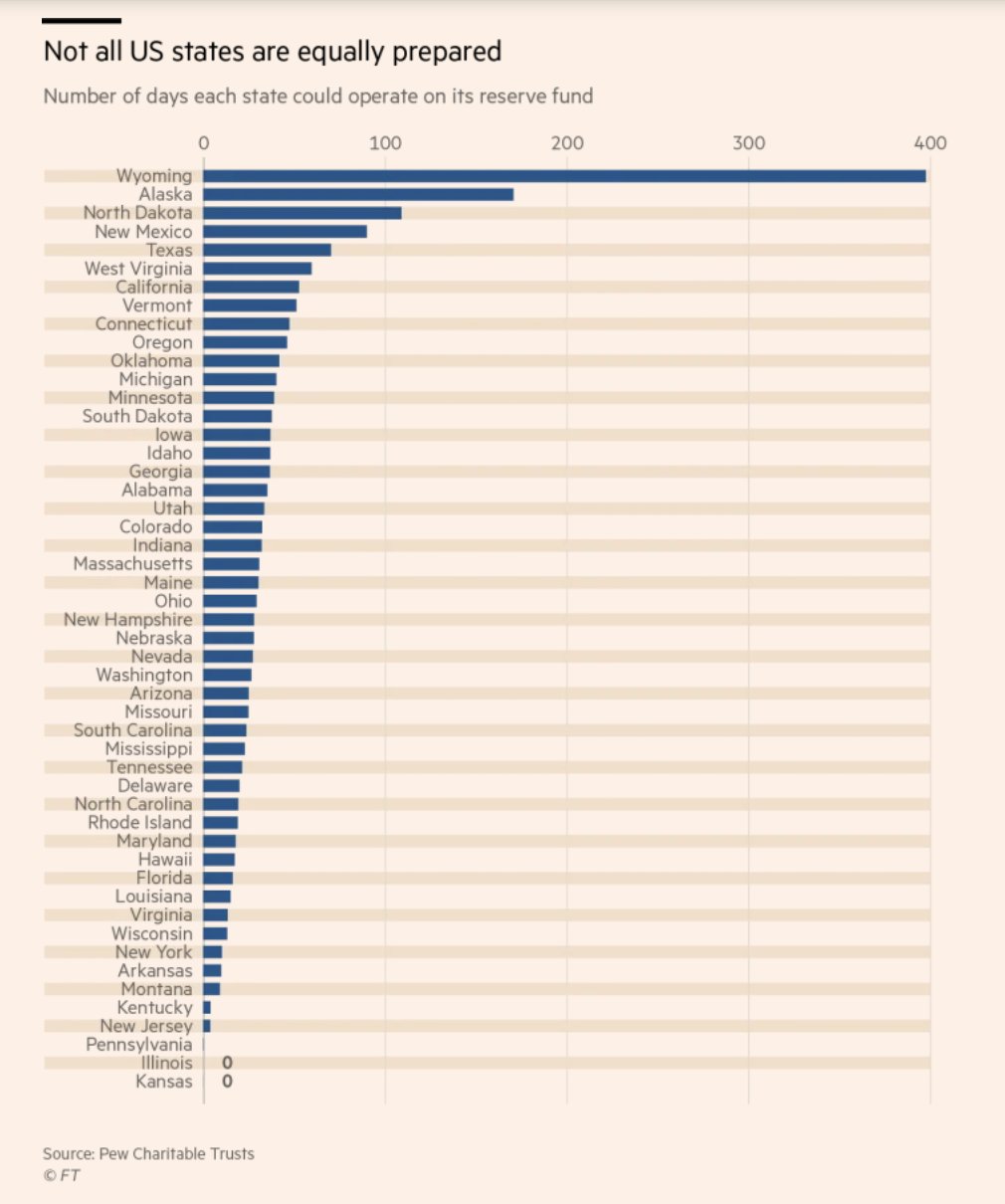

Not sure about months from now if the recession gets deep enough what will happen.

Not sure about months from now if the recession gets deep enough what will happen.