American Rescue Plan Has Passed - Biden to Sign Executive Order Hiking Min. Wage to $15/Hour for Federal Contract Workers. . .Polls: "SPEND MORE!"

Warning: For Full Access Please Log In or Create an Account (Free)

What "card" are you talking about? You only need $1.@Shop-et-al wrote:

I received a card. How does a card become an investment opportunity?

[twitter.com]

This kid is showing people how to turn $1 into $4k in 3 hours.

[twitter.com]

Another is showing how to double their stimmy in 2 weeks.

[twitter.com]

Or, just take the slow path and make $13K/month like Chad and Jenny. You don't need a graduate school degree to make six-figures a year. Apparently, you just need a few hundred dollars and the Robinhood app and you'll be making more than lawyers and MBA's in no time.

Work? Who needs it? Just sit at home in your PJs, eat donuts, and get rich.

Biden admin. extends foreclosure moratorium (previously set to expire end of March) through June 30.

Foreclosure moratorium =/= eviction moratorium, by the way (these are different).

[www.wsj.com]

ETA: Article is weird. Second paragraph quoted looks like a typo. The Biden administration did NOT extend foreclosure moratorium from end of Jan. to end of March in those earlier exec. orders. Those were for evictions. Foreclosures (different) take a year and March (end) was the deadline.........NOW, they ARE extended to June 30. Pretty sure I'm right and WSJ made typo. Feel free to prove me wrong.

Edited 6 time(s). Last edit at 02/18/2021 05:53PM by shoptastic.

Foreclosure moratorium =/= eviction moratorium, by the way (these are different).

[www.wsj.com]

I previously predicted we'd maybe see FHA bailouts, so that remains to be seen how everything plays out. Everything in America is "frozen" right now (no pun intended - given severe weather systems - as I'm talking about debt payments), so it'll be interesting how everything is resolved when all moratoriums end and the economy "opens" back up to normal. What if people and companies still cannot pay? Massive bailout time?@ wrote:

WASHINGTON—The Biden administration extended a federal moratorium on home foreclosures for another three months and expanded assistance for people behind on their mortgage payments during the coronavirus pandemic.

The White House said Tuesday that it would extend a ban on home foreclosures for federally backed mortgages through June 30. President Biden had earlier extended the moratorium, which had been set to expire at the end of January, until the end of March in a series of executive actions on his first day in office. [WHAT?]

Homeowners will now be able to receive up to six months of additional mortgage payment forbearance, in increments of three months, for those borrowers who entered forbearance before June 30, 2020, the White House said. Borrowers who enter into such plans can skip payments if they suffer a pandemic-related hardship but have to make them up later.

ETA: Article is weird. Second paragraph quoted looks like a typo. The Biden administration did NOT extend foreclosure moratorium from end of Jan. to end of March in those earlier exec. orders. Those were for evictions. Foreclosures (different) take a year and March (end) was the deadline.........NOW, they ARE extended to June 30. Pretty sure I'm right and WSJ made typo. Feel free to prove me wrong.

Edited 6 time(s). Last edit at 02/18/2021 05:53PM by shoptastic.

Wait. Third round??? I guess I missed something. Oh, well.

I counted the Dec. 2020 $900B bill as Rd. 2, sestrahelena. So, that means the currently debated $1.9T bill is the third stimulus.@sestrahelena wrote:

Wait. Third round??? I guess I missed something. Oh, well.

As noted earlier, the Democrats have ZERO need for bipartisan approval (60 majority votes). They can immediately pass it with budget reconciliation (51 simple majority votes with Kamala as tie-breaker) if they wanted to.

"wanted to. . . . ." That's the hang up. Their donors are probably trying to talk them down right now ("Don't you dare give a few dollars to the poor and middle-class or I'll withdraw my campaign contributions next term!") or throw in some tax cuts for the rich ("Okay, public pressure is high, so go ahead and pass the stimulus, but try to sneak in a tax cut for us too like you did with the Dec. stimulus. Keep it quiet, though."). That's how our wonderful oligarchical government works. Even when you have the votes to pass stimulus, you gotta make sure Papa Big Money Donor is happy first.

Edited 1 time(s). Last edit at 02/23/2021 01:46AM by shoptastic.

[www.cnbc.com]

Manchin was considering backing Republican Rob Portman's plan of ($300) $1,200/month for 4 months, which would have been $4,800. The House's original plan of ($400) $1,600/month for 5 months would have totaled $8,000, so this was a compromise I guess. Remains to be seen if it is accepted by the House after kicked back to them.

Joe Manchin (possibly the most hated Democrat - by his own base - in America) has caved to support extension of $300 enhanced unemployment through September 6. At $1,200/month for 6 months, that amounts to $7,200.@ wrote:

The deal will extend a jobless benefit supplement at the current $300 per week through Sept. 6, according to NBC News. It will make the first $10,200 in unemployment aid non-taxable to prevent surprise bills. The provision will apply to households with incomes under $150,000 . . .

Democrats aim to approve their latest rescue package before March 14, the day when the current $300 per week unemployment benefit expires. However, the delays Friday threatened its quick passage as the deadline approaches.

Manchin was considering backing Republican Rob Portman's plan of ($300) $1,200/month for 4 months, which would have been $4,800. The House's original plan of ($400) $1,600/month for 5 months would have totaled $8,000, so this was a compromise I guess. Remains to be seen if it is accepted by the House after kicked back to them.

Round III of stimulus has passed both House and Senate and now goes to Biden who will almost certainly sign it into law.

Major Items:

$1,400 Stimulus Check (Per Qualifying Person)

You will get one if you're a single person making under $75,000, part of a married couple jointly filing under $150,000, or a dependent (including adults***) of such persons. Those earning more than that will get declining payment amounts that completely cut off at the $80,000/single and $160,000/married couple level.

***Adults here may include: i.) high school students 17 or older claimed by someone else; ii.) college students claimed by someone else; iii.) elderly adults claimed by someone else; iv.) disabled adults claimed by someone else

$15 Minimum Wage

no

Enhanced $300 Federal Unemployment Insurance

The ongoing federal $300 enhanced supplement to state UI will be extended through to Sept. 6, 2021.

Child Tax Credit

$3,600 for every child under the age of 6.

$3,000 for every child between the age of 6 and 17.

Deposited into family bank accounts directly every quarter/month (still being decided). This is different from previous "tax credits" that give you back money when you file your taxes. This is direct cash aid sent to your bank account immediately. First payments are set to go out in July of this year.

Earned Income Tax Credit Expansion for Childless Workers

Lots of changes here (to be more generous).

The minimum qualifying age is now 19 (previously 24) and the maximum age of 65 is eliminated!

The maximum EITC credit has been upped from $543 to $1,502 (nearly triple) and the maximum benefit qualifying income level from $4,220 to $9,820, at which EITC benefits diminish and begin to phaseout at $11,610 instead of $5,280 for individual tax filers.

COBRA Subsidies

Laid off workers will have 100% of their employer's health insurance premiums paid for/subsidized through September 2021.

eta: Will update this list with more clarity as it comes in...

Edited 4 time(s). Last edit at 03/13/2021 04:03AM by shoptastic.

Major Items:

$1,400 Stimulus Check (Per Qualifying Person)

You will get one if you're a single person making under $75,000, part of a married couple jointly filing under $150,000, or a dependent (including adults***) of such persons. Those earning more than that will get declining payment amounts that completely cut off at the $80,000/single and $160,000/married couple level.

***Adults here may include: i.) high school students 17 or older claimed by someone else; ii.) college students claimed by someone else; iii.) elderly adults claimed by someone else; iv.) disabled adults claimed by someone else

$15 Minimum Wage

no

Enhanced $300 Federal Unemployment Insurance

The ongoing federal $300 enhanced supplement to state UI will be extended through to Sept. 6, 2021.

Child Tax Credit

$3,600 for every child under the age of 6.

$3,000 for every child between the age of 6 and 17.

Deposited into family bank accounts directly every quarter/month (still being decided). This is different from previous "tax credits" that give you back money when you file your taxes. This is direct cash aid sent to your bank account immediately. First payments are set to go out in July of this year.

Earned Income Tax Credit Expansion for Childless Workers

Lots of changes here (to be more generous).

The minimum qualifying age is now 19 (previously 24) and the maximum age of 65 is eliminated!

The maximum EITC credit has been upped from $543 to $1,502 (nearly triple) and the maximum benefit qualifying income level from $4,220 to $9,820, at which EITC benefits diminish and begin to phaseout at $11,610 instead of $5,280 for individual tax filers.

COBRA Subsidies

Laid off workers will have 100% of their employer's health insurance premiums paid for/subsidized through September 2021.

eta: Will update this list with more clarity as it comes in...

Edited 4 time(s). Last edit at 03/13/2021 04:03AM by shoptastic.

Wow... cutoff is extremely low. People tend to forget that the middle class doesn’t stop at $80k per year..... But what do I know?

Very infrequently shopping the Greater Denver Area, Colorado Springs and in-between in Colorado these days.

Esp. for high COL areas. ...Hawaii? CA?@Tarantado wrote:

Wow... cutoff is extremely low. People tend to forget that the middle class doesn’t stop at $80k per year..... But what do I know?

@shoptastic wrote:

Esp. for high COL areas. ...Hawaii? CA?

Uhhh, Colorado.

Very infrequently shopping the Greater Denver Area, Colorado Springs and in-between in Colorado these days.

I know!@Tarantado wrote:

Uhhh, Colorado.

I was asking what about states like that? ...NY...even my VA is high-ish (esp. Northern VA near D.C.).

I was asking what about states like that? ...NY...even my VA is high-ish (esp. Northern VA near D.C.).

Bloomberg has a nice fuller summary of the bill's contents:

-----------> [www.bloomberg.com]

For small biz that's been crushed:

The Restaurants Act asked for $120B for restaurants, which obv. didn't get through, but it's good there is something there to target them. So, PPP went from $500B+ (CARES) to $200B+ (CRRA) to $7.25B (ARP)?@ wrote:

The legislation includes $25 billion to help restaurants struggling from pandemic lockdowns and closures and $1.25 billion for venue operators. The bill also includes $15 billion for targeted Economic Injury Disaster Loans and an additional $7.25 billion for forgivable loans in the Paycheck Protection Program.

Edited 3 time(s). Last edit at 03/10/2021 10:13PM by shoptastic.

[www.cnbc.com]

PUA and PEUC Extensions

PEUC is for those who've exhausted their state's unemployment insurance and still need help.

and a less known aid:

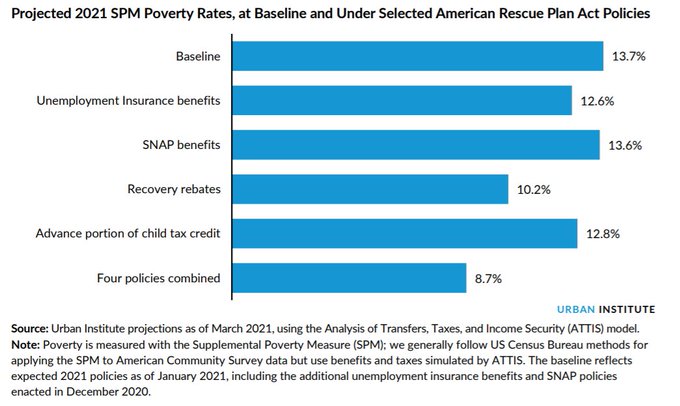

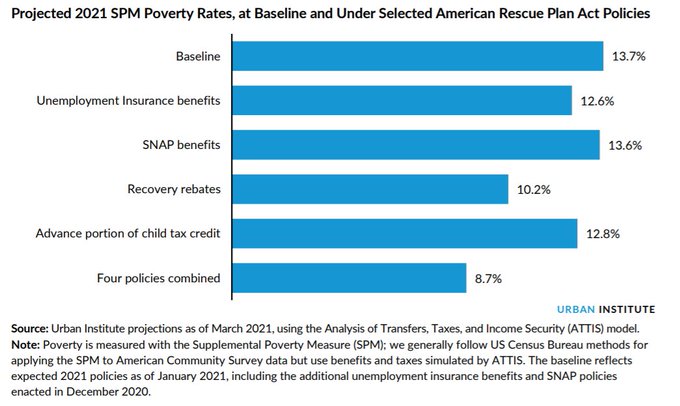

All in all, this was a huge boon to the American people. Various analysis reports that the ARP will cut child poverty by 50% in the U.S. and the combined support of four particular programs will take overall projected U.S. poverty down from 13.7% to 8.7% in 2021.

...Let's do infrastructure next!

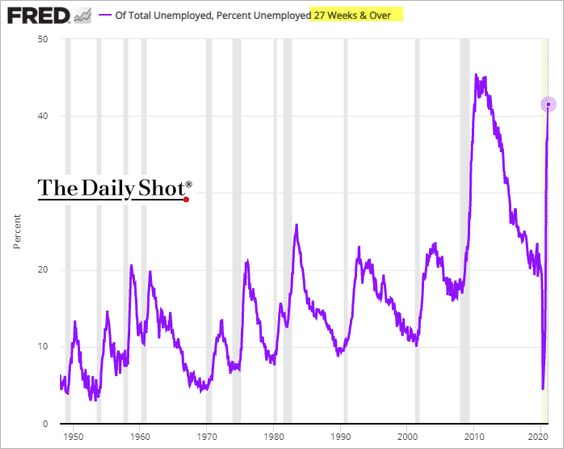

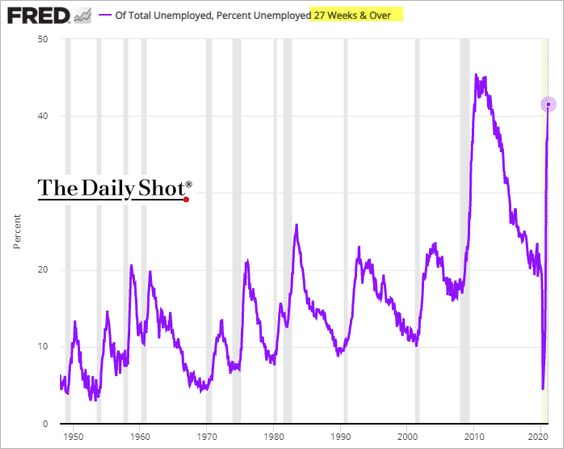

Job creation especially important as the U.S. long-term unemployment rate (27 weeks or more) is fast approaching peak of the 2008-9 Great Recession. This has long-term scarring impacts on people's careers.

Edited 2 time(s). Last edit at 03/11/2021 06:32AM by shoptastic.

PUA and PEUC Extensions

PUA is for mystery shoppers/gig workers/self-employed/independent contractors (i.e., those who don't qualify for regular unemployment)@ wrote:

It also extends the CARES Act programs Pandemic Unemployment Assistance (for gig workers and those not traditionally eligible for aid) and Pandemic Emergency Unemployment Compensation (for the long-term unemployed) until early September. The maximum duration of PUA benefits increases to 79 weeks (up to 86 weeks in high-unemployment states), and for PEUC up to 53 weeks.

PEUC is for those who've exhausted their state's unemployment insurance and still need help.

and a less known aid:

@ wrote:

Mixed Earner Unemployment Compensation, which gives some workers with both W-2 and 1099 income an extra $100 per week in aid, will also extend to Sept. 6.

All in all, this was a huge boon to the American people. Various analysis reports that the ARP will cut child poverty by 50% in the U.S. and the combined support of four particular programs will take overall projected U.S. poverty down from 13.7% to 8.7% in 2021.

...Let's do infrastructure next!

Job creation especially important as the U.S. long-term unemployment rate (27 weeks or more) is fast approaching peak of the 2008-9 Great Recession. This has long-term scarring impacts on people's careers.

Edited 2 time(s). Last edit at 03/11/2021 06:32AM by shoptastic.

"All in all, this was a huge boon to the American people." (opinion)

Maybe, in the short term. In the long term, American people (e.g. American taxpayers) will be paying this debt off for decades in the future. And the ~4 Trillion dollar infrastructure bill hasn't even been released yet.

IS the Govt. giving you a windfall?...

The Govt. has been sending out stimulus checks that's true. But you'd be naive to believe it's with no strings attached.

I know it bores most people, but finance is a major factor in their lives. The 10-year Treasury which many use as an indicator has passed 1.5% and I predict will be near 2% by the end of 2021. That means UP. In case you don't know, it was going DOWN for the last 40-years.

(Some of us remember the early 80's when a car loan was typically 15%, while I remember being invested in Cash Reserves and the payout was 20% interest on cash...wow!)

This means borrowing costs will go up for everyone. Again, inflation will impact everyone. Employee 401K's are likely to remain stagnant in 2021.

Bottom line is that most citizens in the US won't see a net windfall as additional expenses and reduced earnings by many companies (in retirement accnts) will wipe out any stimulus gains in 2021.

The good news is that local economies will begin to resume near normal operations by 2022. So, the "appearance" is that things will seem better.

Thank you Biden policies... ???? /s

[Then again, what do I know. I only successfully planned and executed early retirement 14 years prior to my Social Security full benefits age.]

Maybe, in the short term. In the long term, American people (e.g. American taxpayers) will be paying this debt off for decades in the future. And the ~4 Trillion dollar infrastructure bill hasn't even been released yet.

IS the Govt. giving you a windfall?...

The Govt. has been sending out stimulus checks that's true. But you'd be naive to believe it's with no strings attached.

I know it bores most people, but finance is a major factor in their lives. The 10-year Treasury which many use as an indicator has passed 1.5% and I predict will be near 2% by the end of 2021. That means UP. In case you don't know, it was going DOWN for the last 40-years.

(Some of us remember the early 80's when a car loan was typically 15%, while I remember being invested in Cash Reserves and the payout was 20% interest on cash...wow!)

This means borrowing costs will go up for everyone. Again, inflation will impact everyone. Employee 401K's are likely to remain stagnant in 2021.

Bottom line is that most citizens in the US won't see a net windfall as additional expenses and reduced earnings by many companies (in retirement accnts) will wipe out any stimulus gains in 2021.

The good news is that local economies will begin to resume near normal operations by 2022. So, the "appearance" is that things will seem better.

Thank you Biden policies... ???? /s

[Then again, what do I know. I only successfully planned and executed early retirement 14 years prior to my Social Security full benefits age.]

Biden's going to be giving a major speech tonight, maverick1, which can also be watched live on CNBC's YouTube page:@maverick1 wrote:

And the ~4 Trillion dollar infrastructure bill hasn't even been released yet.

[www.youtube.com]

It comes on 8PM Eastern. He's expected to discuss the way forward for COVID and the economy. For politics and economy nerds, this is like must watch TV. Or, maybe it's a snooze fest for others.

There's talk he may announce massive infrastructure plans. eta: No mention of this. Speech mostly on COVID.

Edited 1 time(s). Last edit at 03/12/2021 01:37AM by shoptastic.

Don't believe everything you hear. Biden and others in his party are building on the work of others without giving credit where credit is due. In academia, this is called plagiarism.

My garden in England is full of eating-out places, for heat waves, warm September evenings, or lunch on a chilly Christmas morning. (Mary Quant)

You mean like this?...

"Isn't it absolutely amazing that Biden's COVID 'strategy' is the SAME as Trump's? Biden was caught with plagiarism in law school and survived, he's doing it again."

Fact Check: [www.washingtonpost.com]

TRUE

"Isn't it absolutely amazing that Biden's COVID 'strategy' is the SAME as Trump's? Biden was caught with plagiarism in law school and survived, he's doing it again."

Fact Check: [www.washingtonpost.com]

TRUE

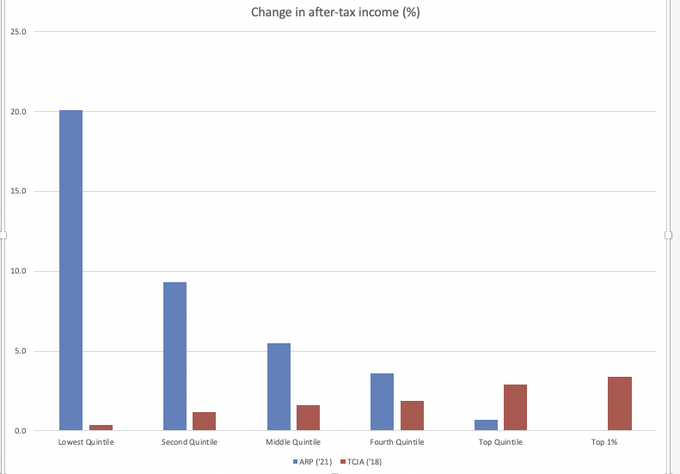

Just a quick response from me for now (I have some agreements and disagreements with your other comments that would take longer to re: ). I thought this was a good visual comparison of ARP and TCJA (Trump's corporate tax cut bill). Both cost us $1.9 trillion:@maverick1 wrote:

Bottom line is that most citizens in the US won't see a net windfall as additional expenses and reduced earnings by many companies (in retirement accnts) will wipe out any stimulus gains in 2021.

But who the money went to ended up being polar opposites.

Nice. I was thinking of the general course of events, which would have proceeded regardless of the name of POTUS. Trump did not unnecessarily delay, and Biden did not magically enhance, the progression of vaccine work. Results of vaccine work now are appearing in the US as three covid-19 inoculation options for the masses.

The link connects to NYT commentary.

[www.nytimes.com]

Edited 1 time(s). Last edit at 03/13/2021 05:55PM by Shop-et-al.

The link connects to NYT commentary.

[www.nytimes.com]

@maverick1 wrote:

You mean like this?...

"Isn't it absolutely amazing that Biden's COVID 'strategy' is the SAME as Trump's? Biden was caught with plagiarism in law school and survived, he's doing it again."

Fact Check: [www.washingtonpost.com]

TRUE

My garden in England is full of eating-out places, for heat waves, warm September evenings, or lunch on a chilly Christmas morning. (Mary Quant)

Edited 1 time(s). Last edit at 03/13/2021 05:55PM by Shop-et-al.

@shoptastic wrote:

Esp. for high COL areas. ...Hawaii? CA?@Tarantado wrote:

Wow... cutoff is extremely low. People tend to forget that the middle class doesn’t stop at $80k per year..... But what do I know?

NY?

The title has changed and informs us that in May, youngsters will become eligible for covid vaccines.

On the plus side, I see this as beneficial for school attendance as accompanied by the known benefits of on-site learning, especially for some learners. (Some learners are equally strong at home and in a school.)

[www.ncbi.nlm.nih.gov]

On the other side, I wonder about one thing. I found this interesting article and linked to it. Have a look, if you are comfortable with NCBI. 'Sex-Based Vaccine Response in the Context of Covid-19' notes that researchers who study vaccines in children do not differentiate by gender, In addition, due to genetics and hormones women have stronger after effects than men do.

In general, how will children experience the vaccine or vaccines? Will they be given smaller doses for their smaller bodies? At eighteen, many things are legal for bodies that continue to grow and develop for a few more years. [We dare not wonder aloud or here about male, female, trans, and/or other children. That would violate all sorts of rules.]

Edited 2 time(s). Last edit at 03/23/2021 09:54PM by Shop-et-al.

On the plus side, I see this as beneficial for school attendance as accompanied by the known benefits of on-site learning, especially for some learners. (Some learners are equally strong at home and in a school.)

[www.ncbi.nlm.nih.gov]

On the other side, I wonder about one thing. I found this interesting article and linked to it. Have a look, if you are comfortable with NCBI. 'Sex-Based Vaccine Response in the Context of Covid-19' notes that researchers who study vaccines in children do not differentiate by gender, In addition, due to genetics and hormones women have stronger after effects than men do.

In general, how will children experience the vaccine or vaccines? Will they be given smaller doses for their smaller bodies? At eighteen, many things are legal for bodies that continue to grow and develop for a few more years. [We dare not wonder aloud or here about male, female, trans, and/or other children. That would violate all sorts of rules.]

My garden in England is full of eating-out places, for heat waves, warm September evenings, or lunch on a chilly Christmas morning. (Mary Quant)

Edited 2 time(s). Last edit at 03/23/2021 09:54PM by Shop-et-al.

I don't know, but often with just over-the-counter meds, children's doses are smaller in quantity, so I typically assume the same would be true of vaccines.@Shop-et-al wrote:

In general, how will children experience the vaccine or vaccines? Will they be given smaller doses for their smaller bodies? At eighteen, many things are legal for bodies that continue to grow and develop for a few more years. [We dare not wonder aloud or here about male, female, trans, and/or other children. That would violate all sorts of rules.]

[www.cnbc.com]

In other news, the CDC has extended the national eviction ban through Sept. 30th.

Question: What happens WHEN people have to start paying? More and more extensions...bailouts? I am not at all suggesting we SHOULD evict people (no opinion, but mostly think everyone - including landlords - should be bailed out right now), but merely asking what the end game will be? What level of evictions would/could the nation tolerate (if any)?@ wrote:

The Centers for Disease Control and Prevention will announce on Monday an extension to its national ban on evictions through the end of June, according to two sources familiar with the matter.

The protection was scheduled to expire in two days, and advocates warned of a spike of evictions if it was not kept in effect.

Around 20% of adult renters said they didn’t pay last month’s rent, according to a survey published in March by the Census Bureau. Closer to 33% of Black renters reported the same.

Edited 4 time(s). Last edit at 03/29/2021 01:08PM by shoptastic.

Some people have not been able to pay rent or mortgage for a year due to unemployment or underemployment and lack of savings. At $1000 to $2000 per month, that's back rent/mortgage of $12,000 to $24,000.

I don't see most of them paying up. There will either be a rash of bankruptcies, or some type of national program to roll these debts into a new financial debt instrument (for renters) to payback over time, or some type of special refinancing of some mortgages (for homeowners and some landlords).

It also seems that the credit reporting agencies might be required to factor out the covid year from their ratings, the same way they had to do a few years ago with unpaid or slow paid medical bills.

I don't see most of them paying up. There will either be a rash of bankruptcies, or some type of national program to roll these debts into a new financial debt instrument (for renters) to payback over time, or some type of special refinancing of some mortgages (for homeowners and some landlords).

It also seems that the credit reporting agencies might be required to factor out the covid year from their ratings, the same way they had to do a few years ago with unpaid or slow paid medical bills.

Both seem to be cheaters, sadly. Mary Trump (niece), in her recent book, said DJT paid a person to take his SAT's, which allowed him to transfer to the Ivy League.@Shop-et-al wrote:

Nice. I was thinking of the general course of events, which would have proceeded regardless of the name of POTUS. Trump did not unnecessarily delay, and Biden did not magically enhance, the progression of vaccine work.

@maverick1 wrote:

"Isn't it absolutely amazing that Biden's COVID 'strategy' is the SAME as Trump's? Biden was caught with plagiarism in law school and survived, he's doing it again."

As for COVID strategy, it felt like Trump's was to quickly infect and kill as many Americans as possible. *probably only slight hyperbole* The "goal" seemed to be to force the virus to run through us quickly, in order to protect corporate profits and his precious stock market (and maybe quickly getting to herd immunity, so his rich elderly friends/donors stuck inside can safely come out again and not have to spend their later years of life in hiding). *just my theory* It's very difficult to explain America's response otherwise (especially, anti-masking). In related news today [www.cnbc.com] :

As for COVID strategy, it felt like Trump's was to quickly infect and kill as many Americans as possible. *probably only slight hyperbole* The "goal" seemed to be to force the virus to run through us quickly, in order to protect corporate profits and his precious stock market (and maybe quickly getting to herd immunity, so his rich elderly friends/donors stuck inside can safely come out again and not have to spend their later years of life in hiding). *just my theory* It's very difficult to explain America's response otherwise (especially, anti-masking). In related news today [www.cnbc.com] :

In other news, Americans seem to be wanting to save those stimmy checks.@ wrote:

Congressional investigators released emails and documents Friday that show Department of Health and Human Services appointees under former President Donald Trump regularly bragged about their efforts to alter staff scientists’ reports on the coronavirus.

Officials tried to rewrite the weekly scientific reports so Trump could use the data to support his political positions on wearing masks and reopening the economy, according to the emails released Friday by the House Select Subcommittee on the Coronavirus.

[www.bloomberg.com]

Next big stimulus fight will be over infrastructure: [www.nytimes.com]

The $2 trillion figure is the exact same amount Trump wanted back in 2019: [www.npr.org]

Edited 1 time(s). Last edit at 04/10/2021 01:48AM by shoptastic.

[finance.yahoo.com]

[www.bloomberg.com]

Edited 1 time(s). Last edit at 04/27/2021 03:30PM by shoptastic.

Yay! . . possibly much needed too with inflation picking up:@ wrote:

President Joe Biden will sign an executive order on Tuesday requiring federal contract workers to make at least $15 an hour. . .the executive order could impact hundreds of thousands of people who are working on federal contracts — giving a raise to low-wage workers including food service workers on military bases and maintenance workers in government buildings.

All agencies must implement the wage hike in new contracts by March 30, 2022. The executive order also requires agencies to implement the higher wage into existing contracts when they are extended.

[www.bloomberg.com]

Time for Trend Source to raise their rates?@ wrote:

This week, the Bloomberg Agriculture Spot Index — which tracks key farm products — surged the most in almost nine years, driven by a rally in crop futures. With global food prices already at the highest since mid-2014, this latest jump is being closely watched because staple crops are a ubiquitous influence on grocery shelves — from bread and pizza dough to meat and even soda.

Rent is also picking up: [www.wsj.com]@ wrote:

“The hottest home-sales market in 15 years is also expected to prop up rents. As more people are priced out of the for-sale market, they will flock to the only other option: renting.”

Edited 1 time(s). Last edit at 04/27/2021 03:30PM by shoptastic.

[www.cnbc.com]

Edited 2 time(s). Last edit at 04/27/2021 08:09PM by shoptastic.

I agree!@ wrote:

Americans support Biden’s spending and want him to spend more, polls show

Multiple recent polls show Americans broadly back the big-ticket spending proposals that have President Joe Biden’s first 100 days in office.

More Americans say they approve than disapprove of the $1.9 trillion coronavirus relief bill Biden signed into law in March. Surveys also find Biden’s $2 trillion infrastructure plan is already popular with majorities or pluralities.

Edited 2 time(s). Last edit at 04/27/2021 08:09PM by shoptastic.

Sorry, only registered users may post in this forum.